2nd Quarter 2024 Quarterly Compass Economic Update

Equity and bond markets began the second quarter of 2024 with a rough start, thanks to the Federal Reserve’s decision not to reduce interest rates due to stubbornly high inflation rates. However, during the quarter, strong performances from companies tied to artificial intelligence and a more favorable outlook on inflation numbers changed that perspective. By the quarter’s end, investors saw multiple all-time-high days, and many records were set for equities. In the first half of the year, 31 records were set for the S&P 500. As a follow-up to the strongest first quarter since the pre-pandemic days of 2019, investors continued to enjoy the bull run in the second quarter.

Big tech and large communication companies contributed disproportionately to the equity market’s rise. The continued confidence in artificial intelligence and the prospect of it ushering in a new era of technology helped fuel the S&P 500. The boom in the technology sector of the market is being led by companies referred to as the “Magnificent Seven”. For the first half of 2024, these seven companies, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla have all helped drive the market. For the quarter, Nvidia alone advanced Morningstar’s U.S. Market Index by 1.6%.

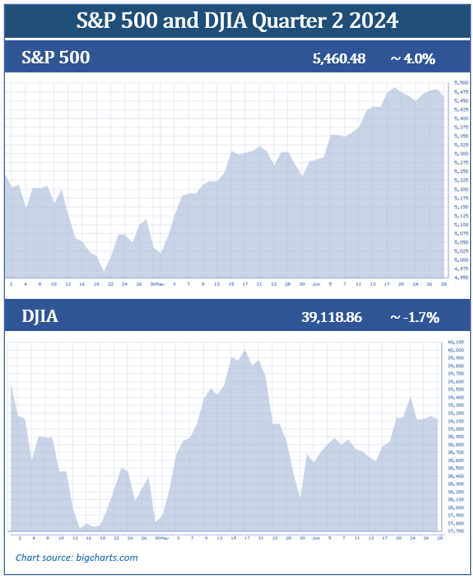

As June ended, all three major indexes were up for the year, with the S&P 500 up approximately 15% and the Dow Jones Industrial Average (DJIA) rising almost 4%.

For the second quarter, the S&P 500 returned nearly 4% and closed the quarter at 5,460.48. The Dow Jones Industrial Average (DJIA), which has less of a tech influence, crossed a new milestone of 40,000 in May but ended the quarter at 39,118.86, down about 1.7%. (www.cnbc.com; 6/28/2024)

The U.S. economy continued to thrive in the second quarter. Employment statistics are considered a strong measure of the economy’s health. The June jobs report reflected that the labor market added 206,000 jobs, but the unemployment rate unexpectedly rose to 4.1%, its highest level since October 2021. This has fueled some more talks of late-year rate cuts because one of the signals the Fed looks for to reduce interest rates is a weaker jobs market.

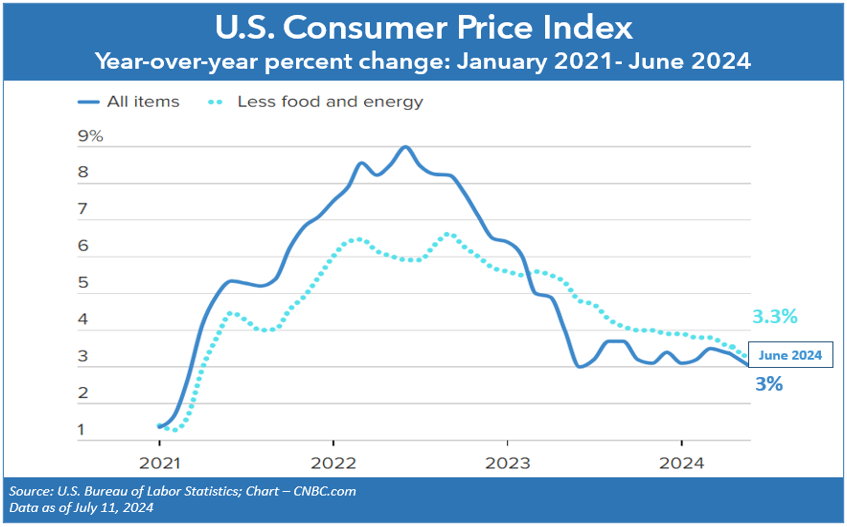

Inflation is still a concern for investors. The Fed closely monitors the Consumer Price Index (CPI), which is a broad measure of goods and services costs, as one of the indicators for interest rate adjustments. The good news is that inflation showed signs of slowing down in both April and May. In May, the Consumer Price Index (CPI) was 3.3%. The core CPI (CPI less food and energy) was up 3.4%. In June, the CPI was 3.0%, and the Core CPI was 3.3%.

The energy index decreased 2.0% in May after rising 1.1% in April. Gasoline, specifically, decreased 3.6% in May, which is good news for summer vacationers. Shelter costs continued to put a strain on consumers and increased by 5.4% on a year-over-year basis. Year-over-year, food at home rose 1.0%, while a trip to a restaurant rose 4.0% in May. (Source: /www.bls.gov/news.release)

Overall, the second quarter of 2024 brought increasing equity returns and continued investor confidence and optimism. While investors can participate in this bull market, it is still wise to be cautious and focused on one’s personal situation.

Inflation & Interest Rates

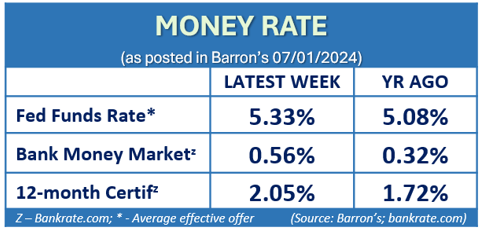

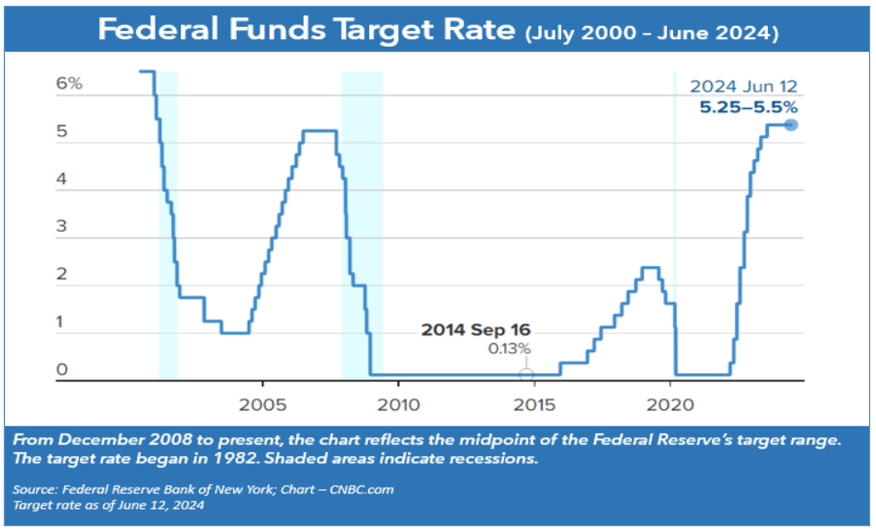

Interest rates were held steady in the second quarter. For the seventh time in a row, at the June FOMC meeting, interest rates remained at a range of 5.25- 5.50%. Interest rates have not changed for nearly a year, since July 2023, when the Fed raised rates by 25 basis points. The stock market has continued to stay strong despite the Fed reducing their previously anticipated rate cuts in 2024 from three down to one. In fact, the S&P 500 closed at an all-time high of over 5,400 for the first time after the Fed noted there was only “modest further progress” toward their 2% inflation goal.

The Consumer Price Index (CPI) was 3.3% while the Core CPI was 3.4% year-over-year in May. In June, the CPI was 3.0%, and the Core CPI was 3.3%. These numbers came in lower than expected and represented a slowdown in the pace of inflation. However, the Fed is now anticipating it will take longer for inflation to get to the preferred 2% range. Currently, Fed officials are predicting 2024 will end at 2.6% and that we will see the coveted 2% target in 2026. (Source: barrons.com, 6/14/24)

There are four more scheduled FOMC meetings in 2024. Starting the year, it was anticipated that we could see three rate cuts in 2024; however, as of June, the consensus seems to lean toward only one quarter-point rate cut by the end of 2024.

After the June meeting, the official Federal Reserve FOMC statement stated, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

“What we’ve been getting is good progress on inflation with growth at a good level and with a strong labor market. Now, ultimately, we think rates will have to come down to continue to support that,” Fed Chair Jerome Powell said at the June FOMC meeting. He continued, “But so far, they haven’t had to. And that is why we’re watching so carefully for signs of weakness.”

The Fed is committed to reaching a 2% inflation rate and will be closely watching key indicators, including labor market conditions, inflation pressures, and financial and international developments.

Interest rates and inflation are integral to investors and their financial planning, so we will continue to monitor any movements and stay apprised of key economic indicators.

The Bond Market and Treasury Yields

The news of improved inflation numbers and the Fed’s continued commitment to cut interest rates in 2024 helped bond markets in the second quarter.

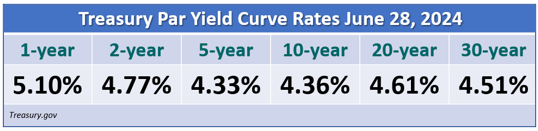

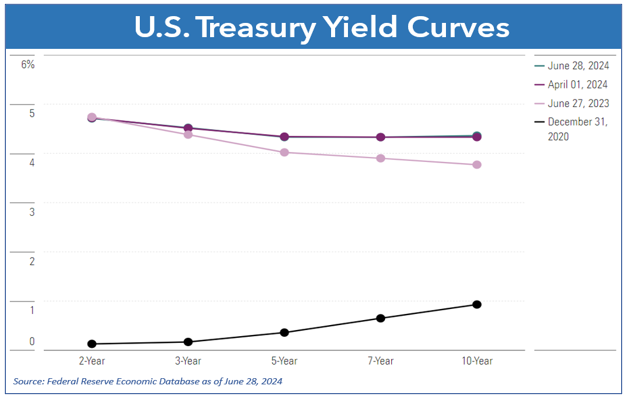

The treasury yield curve remained inverted for the second quarter. This means that shorter-term treasuries yielded more than longer-term treasuries. This inverted yield curve has been long running, beginning in July of 2022 – nearly seven consecutive quarters.

While typically economists see this as a sign of a potential recession or poor market performance in the near future, we have yet to see this come to fruition.

The quarter ended with the benchmark 30-year yield at 4.51%, which was higher than the first quarter ending at 4.34%. The 20-year yield settled at 4.61%, which was 0.16% higher than the first quarter ending.

Bond prices and interest rates have an inverse relationship. When interest rates go down, the price of bonds go up and vice versa. The Fed is still anticipating at least one interest rate cut in 2024, which could narrow the opportunity to get lower-risk, higher-yielding bonds.

Please contact us if you are interested in adding bonds as part of a diversified portfolio. As your wealth manager, we want to help you make the best decision for your portfolio. We will continue to closely monitor how the Fed’s movements are affecting bond yields. Please remember that while diversification in your portfolio can help you pursue your goals, it does not ensure a profit or guarantee against loss.

Investor’s Outlook

The S&P 500 continued to create all-time highs in the second quarter, helping make the first half of 2024 a strong one for investors.

We are currently experiencing a bull market, and the question is how long it can last. Many continuing uncertainties surround the economic environment, including interest rates, the pace of inflation, the pace of economic growth, and the 2024 U.S. presidential election.

While the U.S. is on a “disinflationary path,” the Fed is now expecting only one interest rate cut for 2024 in September. Before this happens, however, Fed Chair Powell noted, “We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.” (Source: cnbc.com, 6/12/24)

Currently, the U.S. economy continues to show signs of strength and resilience. Positive inflation numbers will be key to the Fed being confident enough to start cutting rates. Should the economy maintain a healthy status, we may see the soft landing the Fed has been aiming for. However, should the economy experience a slowdown, concerns of a recession could increase.

We continue to stand by our mantra of “proceed with caution” over these coming months. Maintaining a long-term approach to equities and staying apprised of economic data could help you stay one step in front of potential market volatility. We believe an educated client is the best client and we strive to keep you updated in areas that could affect your situation.

As mentioned, as the first half of the year closed, the S&P 500 was up approximately 15%. The S&P 500 has gained 15% or more in the first half of the year 13 other times. The good news for investors is that historically, each of those years ended in the black, ranging from more than 46% in 1933 to as little as 2% in 1987 during the year we experienced the Black Monday Crash – the only one of these years the total yearly gain was not in the double digits. Looking at individual quarters, historically, a majority of the third quarter of these years was down 1.2% but then regained strength in the fourth quarter, with a median rise of 4.7% (Source: Barrons; 6/28/24)

According to FactSet Data compiled by CNBC, as of the quarter’s end, the stock market is experiencing its longest stretch (over 380 days) without a 2% sell-off since the financial crisis. This current streak has proven to be healthy for many investors, but remember, many famous quotes start with the same three words, “nothing lasts forever”. It would not be unusual to see some type of pullback or downturn in equity markets. However, historically, more times than not, after a good first half, equity markets have advanced in the year’s second half.

So, what does this mean for investors for the remainder of this year? While previous performance is not a guarantee of future results, should history repeat itself, there is a strong chance that the noteworthy rally we are experiencing will still be prevalent through the end of this year.

On the other hand, some strategists have more bearish outlooks, such as Stifel’s Chief Strategist Barry Bannister, who believes that the S&P 500 could see a 10% pullback due to the index being overvalued coupled with an uncertain monetary policy environment. (markets.businessinsider.com; 6/27/24)

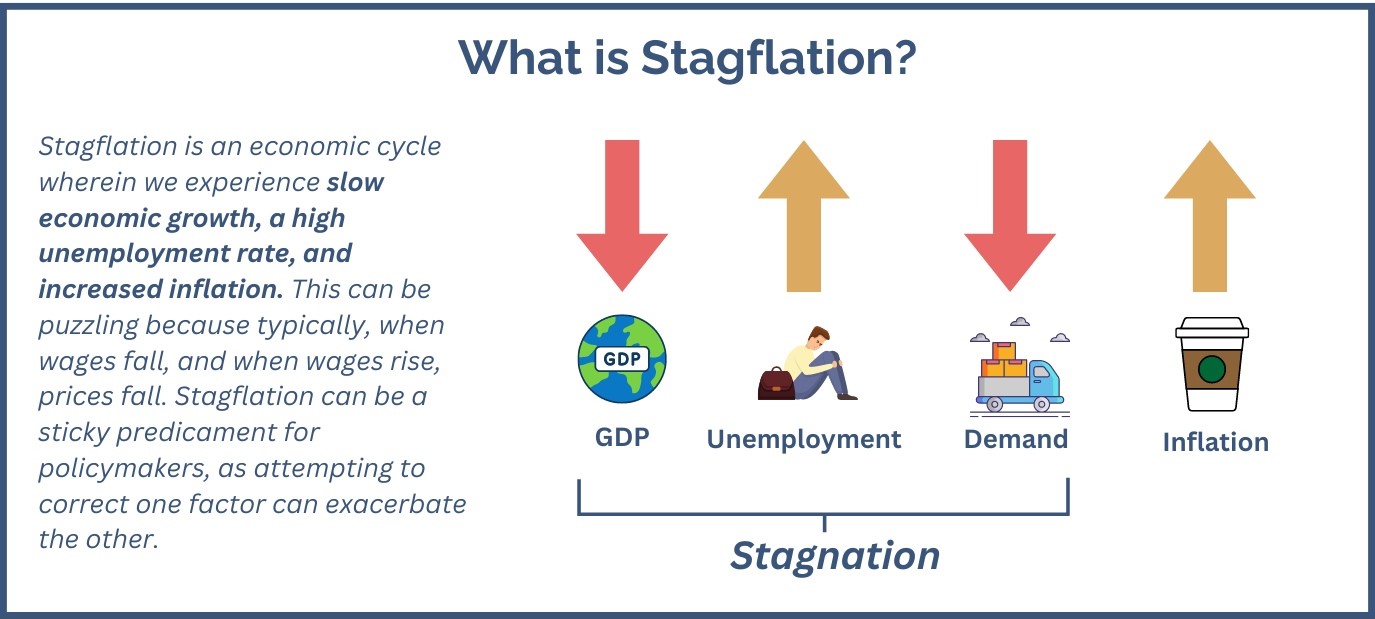

Talk of “stagflation” is emerging in the news. Stagflation is an economic cycle wherein we experience slow economic growth, a high unemployment rate, and increased inflation. This can be a precarious situation to fix for policymakers, as attempting to correct one factor could aggravate another. Fed Chair Jerome Powell is confident that we are not in a state of stagflation, stating that he sees neither the “stag, nor the ‘flation,” and that he didn’t “really understand where talk of stagflation scenario is coming from,” in remarks after the release of the May 1 FOMC meeting. (Source: nbcnews.com; 5/1/24)

As you can see, speculations vary. Will we experience an overdue pullback? Will we continue to enjoy the bull market?

We believe that speculation is not a good strategy. Instead, staying vigilant and focused on your own well-devised, long-term personal situation is a wiser investment strategy.

Volatility is still a concern moving into the coming months. Maintaining a long-term approach to investing should still be a benchmark for smart investors. We will continue to focus on key factors that could affect your personal situation, including economic growth, inflation movement, monetary policy moves, and interest rate changes.

Other areas we are keeping an eye on include:

- Global tensions, including those in the Middle East and the continued Russia-Ukraine war.

- Corporate earnings for the second quarter, which could also affect the direction of equities.

- November elections. Please remember that typically, economic and inflation trends affect equities markets more than election results.

Now, as always, is a time to stay focused on your personal objectives. One of our goals is to help you create a solid financial strategy that considers your risk tolerance, time horizon, and potential tax implications.

If you have any questions or want to make any changes to your financial situation, please contact us. We always recommend discussing any changes, concerns, or ideas that you may have with us prior to making any financial decisions so we can help you determine your best strategy and make sure your plan is still in alignment with your goals.

We want to exceed your expectations. We take pride in offering services that include:

- A proactive, individually tailored approach to our client’s financial goals and needs.

Consistent and meaningful communication throughout the year. - A schedule of regular client meetings.

- Continuing education for our team members on issues that may affect our clients.

- Proactive planning to navigate the changing environment.

We value our clients and are accessible to them. If you would like to explore our services, feel free to contact us with any concerns or questions you may have.

team@stablerwm.com | (425) 646-6327

Securities and financial planning services provided through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC.

Note: The views stated in this letter are not necessarily the opinion of broker/dealer, and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. This material contains forward-looking statements and projections. There are no guarantees that these results will be achieved. All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. The modern design of the S&P 500 stock index was first launched in 1957. Performance prior to 1957 incorporates the performance of the predecessor index, the S&P 90. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is no guarantee of future results. CDs are FDIC Insured and offer a fixed rate of return if held to maturity. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed.

There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns out outperform a non-diversified portfolio. Diversification does not protect against market risk.

This content was prepared by APFA (Academy of Preferred Financial Advisors). Sources: www.cnbc.com; www.federalreserve.com; www.tradingeconomics.com; www.bankrate.com; www.forbes.com; www.nerdwallet.com; Investopedia.com; www.morningstar.com; www.bigcharts.com

Category

Stay Informed

Join our mailing list to receive monthly newsletters with information that impacts your financial decisions.

Certified Financial Planner

In Business 35+ Years