4th Quarter 2022 Economic Update

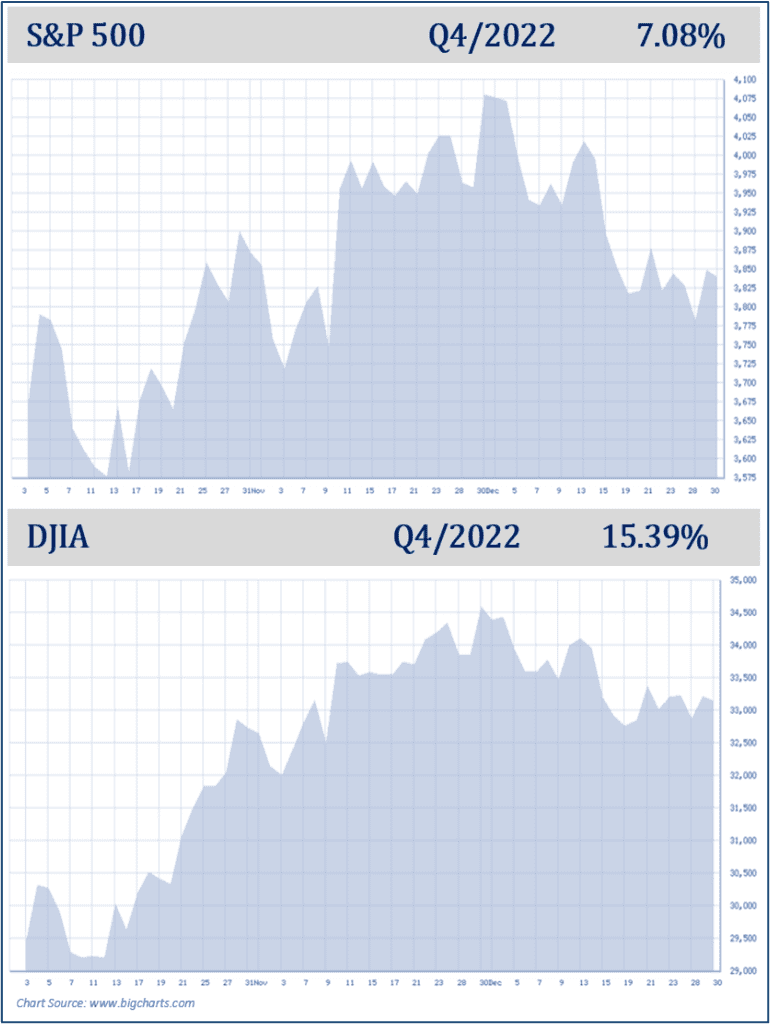

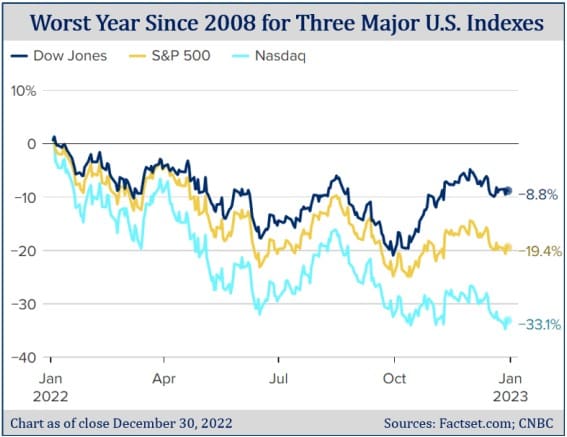

Although the yearly results were discouraging, the fourth quarter of 2022, despite its volatility and uncertainty, brought slight improvements in the U.S. equity markets. The Dow Jones Industrial Average (DJIA) closed out at 33,147.25, ending the year down 8.8%. Similarly, the S&P 500, closed at 3,839.50 to close out the year down 19.4%. (Source:cnbc.com 12/29/22)

During 2022, inflation, rising interest rates, slowing economic growth, the weakening of fiscal and monetary stimulus – all packed a bearpaw-sized punch to investor’s portfolios. Recession fears also played a key role in the direction of the market. All these major factors allowed volatility to prevail and investors rode a steady downward trend throughout the year. 2022 was a solid practice in emotional resilience and trust in the long-term perspective of investing.

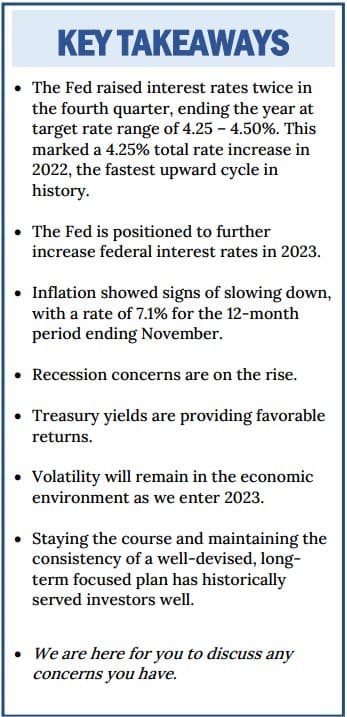

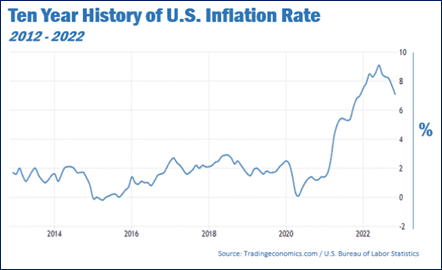

On a positive front, the Fed’s efforts to slow down the rate of inflation finally began to show quantifiable results. The U.S. annual inflation rate experienced a slowing down and was 7.1% for the 12-months ending November 2022.

As we close out what was undoubtedly a rough year for equity markets, investors are bracing for another potentially mercurial year. As your financial professional, we are committed to keeping you apprised of any changes and activity that could directly affect you and your unique situation.

Inflation & Interest Rates

In 2022, Americans saw seven federal interest rate increases, ending the historically low interest rates that were enjoyed since the “Great Recession” from 2007-2009.

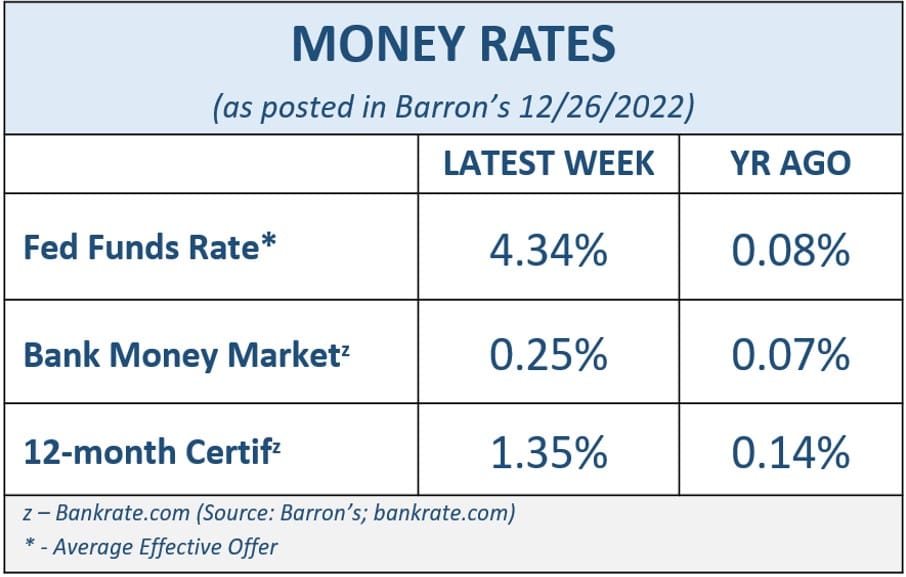

In their efforts to use interest rate increases to lower inflation, the Fed raised interest rates twice in the fourth quarter of 2022. In November, rates increased 0.75% for a target rate range of 3.75 – 4.00%. Then, as planned, the Fed again raised rates at the December meeting. However, because inflation started to show potential signs of slowing down in the months prior, the Fed raised it by only 50 basis points, for a target rate range of 4.25 – 4.50%. This marked a 4.25% total rate increase in 2022, the fastest upward cycle of interest rates in history.

The labor market remains a key factor in how the Fed will adjust its attack on inflation and when and how fast it will change policy. Job growth remained strong in November, keeping the unemployment rate at 3.7%. At their December FOMC meeting, the Fed predicted a rise in the unemployment rate, looking at 4.6% by the end of 2023. Later in the month of December the unemployment rate actually moved to 3.5%. (Source: Bureau of Labor statistics)

Fed Chair Jerome Powell suggested that in 2023 we may not see as sharp of increases as this year, when rates were quickly increased to jump start the Fed’s key weapon to fight inflation. It is likely that at the Fed’s first meeting on February 1, 2023, they will continue to raise rates, but potentially by a smaller percentage point than we have seen in the past several rate changes. Regardless of how the Feds adjust their tactics, it is expected that they will continue to be in a tightening approach toward inflation until they see a weakening in the labor market.

“It’s very premature in my view to think about or be talking about pausing our rate hikes,” said Powell at the November press conference following the Federal Open Market Committee (FOMC) meeting. At their December meeting, the FOMC shared their economic projections that pointed to a possible interest rate range of 4.75 – 5.75% in 2023. “It’s not as important how fast we go,” he stated, “Our focus right now is really on moving our policy stance to one that is restrictive enough to ensure a return of inflation to our 2% goal over time,” Powell said. (Source:reuters.com, 12/14/22)

Results for U.S. inflation peaked in the fourth quarter and both headline and core Consumer Price Index (CPI) readings showed significant year-over-year declines to close out the year. The annual U.S. inflation rate for the 12-month period ending November 2022 was 7.1%, down 2% from June’s 12-month period high of 9.1%. This denoted progress in the Fed’s fight to slow the rate of inflation down. (Source: usinflationcalculator.com)

This was the data investors had long been waiting for and they expressed their approval by sparking quick, but short-lived equity market relief rallies. This initial descent from the inflation summit can be encouraging, but it takes more than one data point to make a trend. We will monitor inflation numbers as the 2023 data becomes available.

The Fed is watching other key economic indicators in addition to unemployment rates, including personal consumption expenditures (PCE), and consumer price index (CPI). “The inflation data received so far in October and November show a welcome reduction in the pace of price increases, but it will take substantially more evidence to give confidence inflation is on a sustained downward path,” Powell said at the December FOMC meeting. (Source:reuters.com, 12/14/22)

We will keep a vigilant eye on the federal interest rate movements and inflation. When rates will stagnate and for how long they will remain there is yet to be seen.

Due to the continued rise of interest rates, we continue to suggest that, if you haven’t already done so, please take a look at these key areas of your financial situation:

- The cost of borrowing is up, therefore:

- proactively pay off all non-essential interest-bearing debt.

- maintain liquidity for short-term purchases.

- If you have a mortgage, review your rates with us. Mortgages rates have hit a two-decade high, reaching above 7%. While home prices are still robust, this sharp rate increase is bringing down home prices.

- If you have bonds in your portfolio, understand their duration.

- Review all income-producing investments.

As financial professionals, we are committed to keeping a vigilant eye on all aspects of financial planning that may affect our clients, including interest rates and inflation. If you are concerned about how these may affect your portfolio, please contact us to discuss any strategies that may help combat the effect on your personal situation.

The Bond Market and Treasury Yields

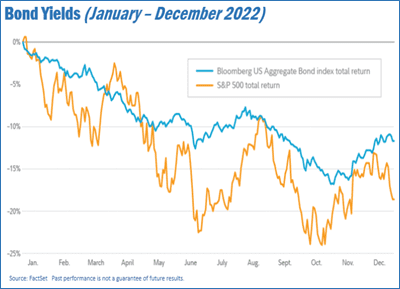

Simply put, bonds had a terrible year as the bond market had one of its worst years in history. The total return of the Bloomberg Aggregate Bond Market Index (which dates back to 1976) of -13% in 2022 was far and away the worst loss ever for this total bond market index. For those with S&P U.S. Treasury Bonds, the return was -10.7% in 2022. (Source:cnn.com, 12/30/22)

Bond prices and bond yields are inversely related. When prices go down, yields go up.

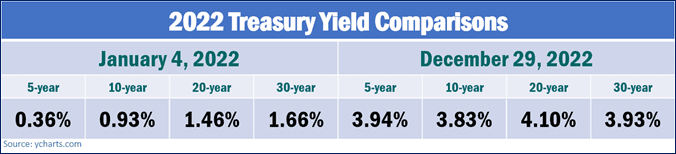

Now that rates have risen, Treasury yields in this environment can be a viable asset class for a diversified portfolio. As of December 30, 2022, 5-year notes yielded 3.99%, 10-year notes yielded 3.88%, 20-year notes yielded 4.14%, and 30-year notes reached 3.97%. The 1-year treasury rate reached 4.73% on December 30 after a fourth quarter high of 4.80% on November 7. (Source: ycharts.com)

Investing in bonds can help diversify your portfolio. Bonds can be a good option for a conservative, balanced portfolio, as they are typically considered more stable than stocks. However, bond investing, particularly when considering individual bonds, can be tricky. The window of opportunity to get lower-risk, higher yielding bonds could be short-live if the Fed’s feel the need to cut rates to prevent a recession. As we have already shared, bond prices and interest rates move in the opposite direction. Should the Fed decide to do a reversal and cut rates, the opportunity for this strategy could expire.

Also, please remember, while diversification in your portfolio can help you reach your goals, it does not ensure a profit or guarantee against loss. If you’d like to explore how bonds could fit into your retirement income strategy, please contact us so we can help you make the best decision for your portfolio.

We will continue to monitor how the Fed’s movements and rising interest rates are affecting bond yields.

Investor’s Outlook

News of a recession remains front and center. Many analysts fear the Fed’s hawkish moves to fight inflation at the expense of economic growth is driving the U.S. into an inevitable recession. However, at the December FOMC meeting, the Fed projected an economic growth of 0.5% in 2023. Although very modest, it is still positive growth. (reuters.com, 12/14/22)

“Two-in-three economists are forecasting a recession in 2023, yet corporate earnings estimates haven’t come down to reflect that,” noted Greg McBride, CFA at Bankrate. He continued, “If the economy continues to slow and quarterly earnings calls in January reveal a dour outlook for the year, corporate earnings estimates will be marked down and the market could have a renewed tumble.” (Source: bankrate.com 12/28/22)

Many experts also maintain that the current inverted yield curve (short-term rates are higher than some long-term rates) is indicative of a recession. However, if, when, and how severe a recession should occur in 2023 is all still speculation.

Some economists believe the U.S. will narrowly avoid a recession as core PCE inflation slows from 5% now to 3% and we will continue to see a reasonable unemployment rate in late 2023. (Source: goldmansachs.com 11/16/22)

Even with the possibility of a recession on the horizon, the Feds still stand by their goal of a 2% inflation target. Chair Jerome Powell stated, “the largest amount of pain, the worst pain, would come from a failure to raise rates high enough and from us allowing inflation to become entrenched.” (Source:reuters.com, 12/14/22)

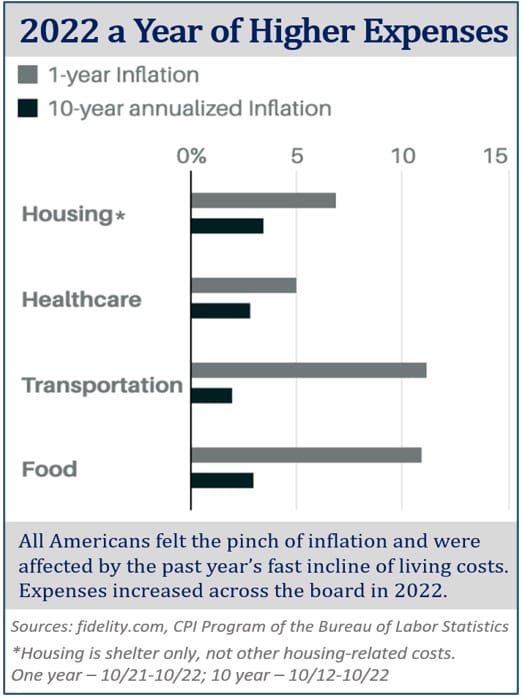

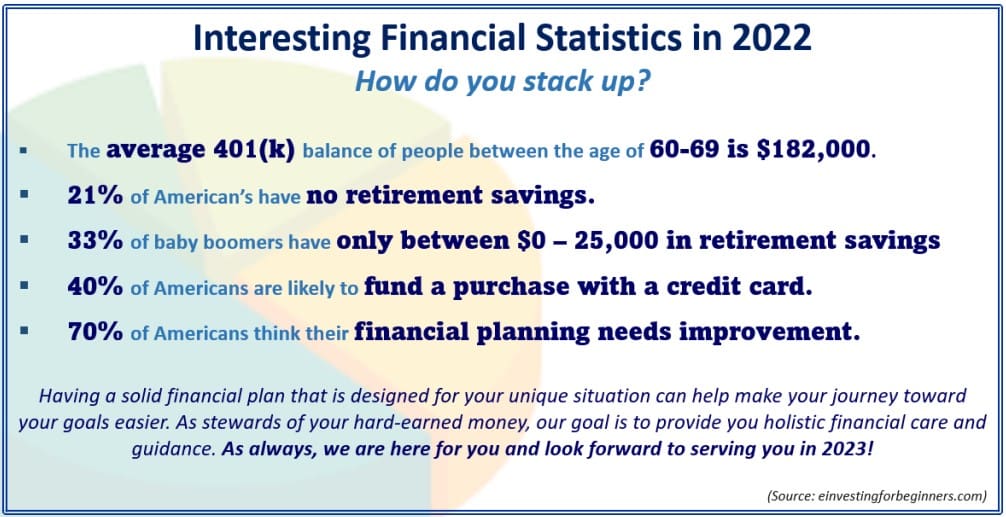

As the Feds keep tightening monetary policy, consumers may need to continue to tighten their budgets. From food, fuel, energy, and everything in between, Americans are paying more for just about everything. Refocusing and revamping your budget now could provide direction and clarity on where your money is going, what is a necessary expense, and what is discretionary in this new year.

The bear market is expected to continue at least into the first part of 2023. Bear markets are a very normal and reoccurring part of the investment experience. How long this bear market will last is yet to be seen. While no one can predict its end, history shows that the average bear market since the modern S&P 500’s inception in the 1920s lasted an average of 19 months (Source: cnb.com; 6/13/22)

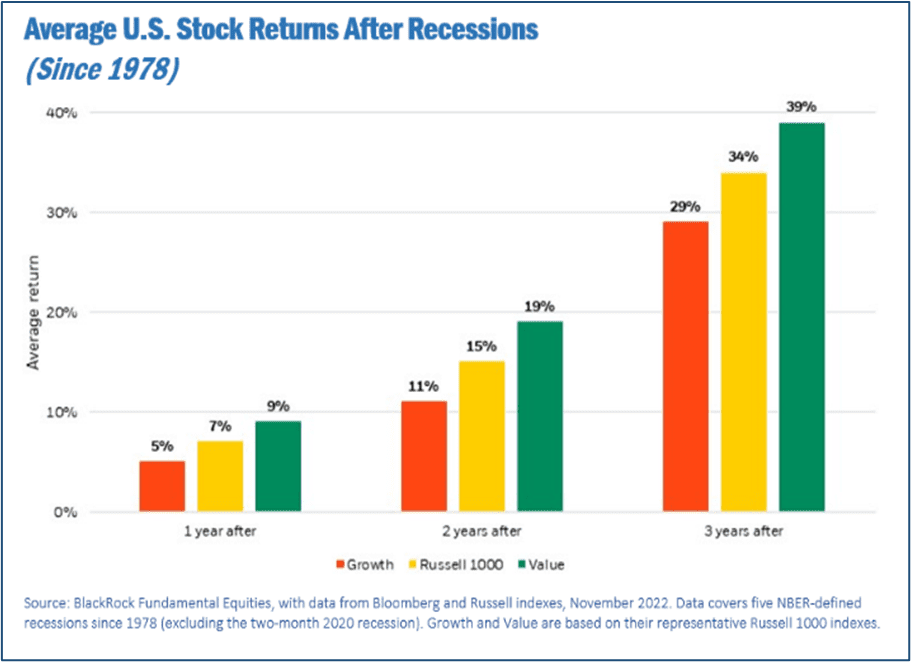

While we can all try to foresee the future, no one can predict the length or severity of any recession. Our goal as your financial professional is to not try to predict the future but provide you with a solid financial plan that is designed to best weather any market environment. However, while past performance is not a guarantee of current or future results, history shows us that returns from equities after a recession have been fruitful.

Some key areas we are watching for 2023 include:

- Inflation rates

- Continued rising interest rates

- Economic growth rate

- Tightening of monetary policy

Although these areas are at the forefront, we must also look at other ongoing global concerns, including:

- The Russian-Ukraine war is still very active, with no end in sight.

- China’s “re-opening” after their strict “zero-COVID” policy was lifted is off to a slow start.

- Slow global growth. Some analysts suggest that global growth will only be at 1.7% in 2023, down from the approximately 6% growth rate in 2021 and 3.2% growth rate in 2022. (Source: Barclays Q1 2023 Global Outlook)

The Fed’s goal is to achieve a “soft landing” but balancing the fine line of avoiding a recession yet slowing growth enough to put the brakes in inflation is a daunting battle it will continue to wage into 2023. What does this mean for investors? Continued uncertainty and volatility.

We stand by the mantra of “proceed with caution”. Patience will indeed be a virtue as the current financial markets we are experiencing will continue to be challenging. Two words should resonate with wise investors during these times: long term. Investing in equities should be viewed as a long-term commitment. Historically, investors who chose to ride out bear markets were rewarded for their patience with healthy returns.

Our goal as the steward of your wealth is to help you through challenging times like these. We always attempt to help you create a well-crafted plan customized for your unique situation and goals that takes into consideration how you will react to the markets ups and downs, including your time horizon, tax implications, liquidity needs, risk tolerance, and your overall personal objectives.

We always recommend discussing with us any changes, concerns, or ideas that you may have prior to making any financial decisions so we can help you determine your best strategy. There are often other factors to consider, including tax ramifications, increased risk, and time horizon changes when altering anything in your financial plan.

These are challenging times for investors. Heading into this new year, we are grateful for your confidence and trust. We will continue to offer first class service to our clients, maintain a proactive approach to your financial goal, and stay apprised of any situations that may affect you.

As always, please feel free to contact us with any concerns or questions you may have.

We pride ourselves in offering:

- Individualized advice tailored to your specific needs and goals.

- Consistent and meaningful communication throughout the year.

- A schedule of regular client meetings.

- Continuing education for all our team

members on issues that may affect you. - Proactive planning to navigate the changing environment.

Remember, a skilled financial professional can help make your financial journey easier. Our goal is to understand your needs and create an optimal plan to address them.

team@stablerwm.com | (425) 646-6327

Securities and advisory services offered through LPL Financial, Member FINRA/SIPC and an SEC Registered Investment Advisor. Stabler Wealth Management and LPL are separate and unaffiliated. Stabler Wealth Management is not a registered investment advisor or broker-dealer. This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer, tax or financial professional. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Note: The views stated in this letter are not necessarily the opinion of LPL Financial, and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. Material discussed herewith is meant for general illustration and/or informational purposes only, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice.

This material contains forward looking statements and projections. There are no guarantees that these results will be achieved. All indices referenced are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. The modern design of the S&P 500 stock index was first launched in 1957. Performance prior to 1957 incorporates the performance of the predecessor index, the S&P 90. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. The Russell 1000 Index consists of the 1,000 largest securities in the Russell 3000 Index, which represents approximately 90% of the total market capitalization of the Russell 3000 Index. It is a large-cap, market-oriented index and is highly correlated with the S&P 500 Index. The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Past performance is no guarantee of future results. CDs are FDIC Insured and offer a fixed rate of return if held to maturity. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed.

There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There is no guarantee that a diversified portfolio will enhance overall returns out outperform a non-diversified portfolio. Diversification does not protect against market risk.

Sources: www.cnbc.com; www.usatoday.com; www.reuters.com; www.barrons.com; www.usinflationcalculator.com; www.forbes.com; www.blackrock.com; www.bankrate.com; www.goldmansachs.com; www.cib.barclays.com; www.cnn.com; www.bigcharts.com. Contents provided by the Academy of Preferred

Financial Advisors, 2023©

Category

Stay Informed

Join our mailing list to receive monthly newsletters with information that impacts your financial decisions.

Certified Financial Planner

In Business 35+ Years