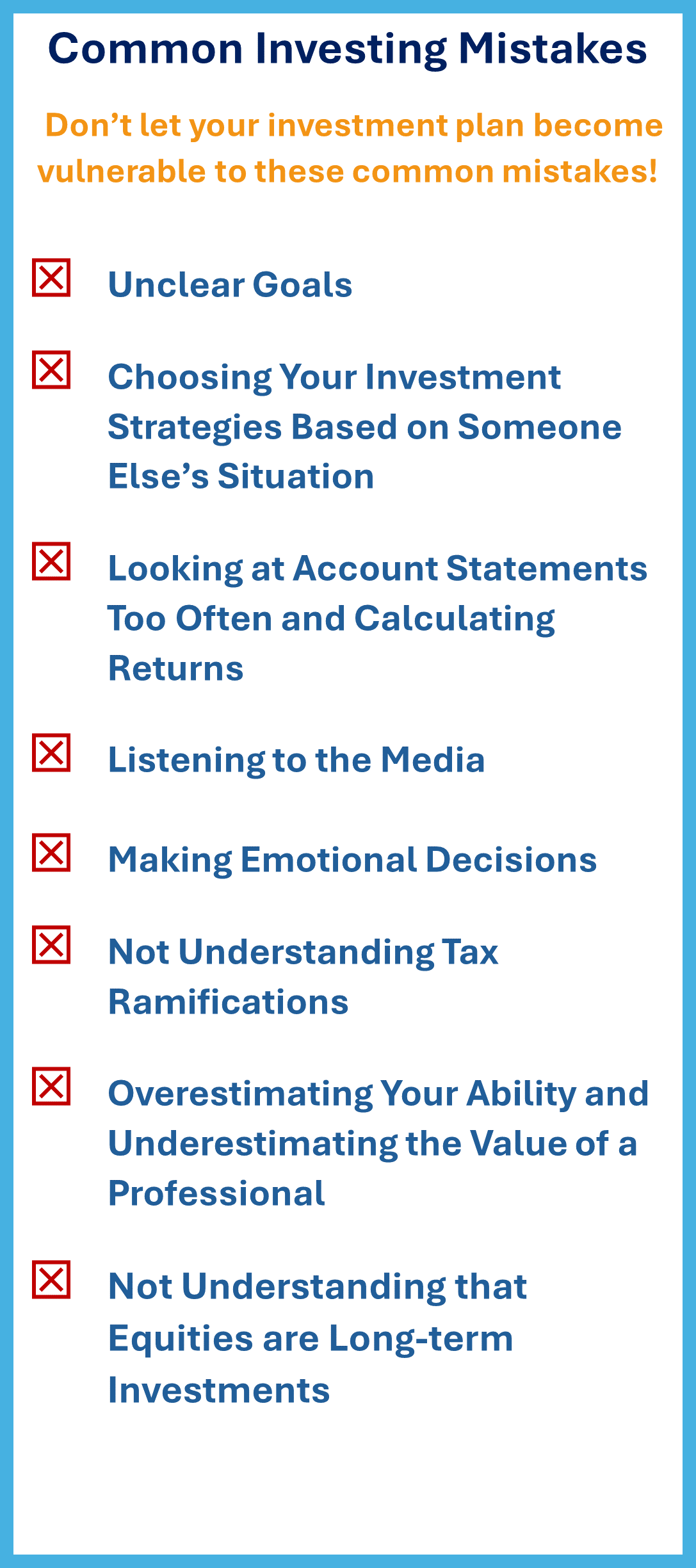

Common Investing Mistakes to Avoid

Whether someone has $50,000 or $5,000,000 to invest, there are several investment pitfalls that any investor can fall into. One of our goals as financial professionals is to help clients avoid these pitfalls, which could be very costly. We have come across many mistakes and firmly believe that it could be much easier and less expensive to learn from others’ mistakes, rather than make them yourself.

Over the years, we have found the following items to be the most common investing mistakes we see investors experience. If you feel that you are or have been affected by any of these, please contact us and we would be happy to reassess your personal financial situation.

Unclear Goals

Most investors attempt to make the most of their investments. Being proactive and having clear goals and objectives in mind can help you optimize your situation. Benjamin Franklin coined the phrase, “If you fail to plan, you plan to fail,” and this holds merit when it comes to your investing strategy.

Once you have determined your goal, creating a comprehensive plan that will help you weather anything that equity markets can bring is recommended. The last few years have taught investors that anything can happen so it’s healthy to plan for the possibility of expecting the unexpected. Not having a well devised plan that considers your risk tolerance, investment horizons, and investing habits, could reduce your ability to optimize your investments or worse, cost you over time.

Your clear goals will help you stay focused and help dissuade you from going off course in times of uncertainty and volatility.

Choosing Your Investment Strategies Based on Someone Else’s Situation

“This is what my smart friend is doing,” is usually not a phrase that should follow when choosing your investment strategy. It’s easy to look at what someone else is doing and, if they are having success with it, be tempted to do something similar. However, their situation may be entirely different than yours: their starting point of entry could vary; their short-term and long-term needs could be different; they could have a higher risk tolerance; and their time horizon could be longer or shorter than yours. There are too many variables to entertain a strategy because, “someone else is doing it.” We understand that the infamous pressure of FOMO (Fear of Missing Out) could rear its ugly head when someone is having success with one strategy, but jumping on board that strategy without taking into consideration your unique situation could be a costly mistake. This is sometimes referred to as the bandwagon effect – a phenomenon in which people do something primarily because other people are doing it.

Choosing investment strategies should involve critical consideration and thinking. With the help of an investment professional, do your due diligence before making any investments strategy changes or moves.

Anxiety From Looking at Account Balances Too Often

Looking at your investment balances too often can lead to an unhealthy habit. The thing to keep in mind is that investing is a long-term activity, and day-to-day changes should not affect your strategy and decisions. Checking too often can lead to stress and reactive and impulsive decisions. Well devised plans can take time and being impatient can prove to be harmful.

Listening to the Media

Many times, it’s best to avoid or limit media exposure. This is worth repeating: avoid or limit media exposure!

The media knows very well that fear sells and will go to great lengths to keep you in their audience. Unfortunately, the media gets more attention when it is filled with fear-mongering and negative news that can influence even the most seemingly impenetrable viewers.

Focus on your personal goals and objectives and don’t let media outlets reduce your confidence or commitment to your well-devised plan.

Making Emotional Decisions About Investments

We each know our true investing behavior and it can be easy to make emotion-based decisions. Whether it is the media, our next-door neighbor, or just a hunch, making an emotionally triggered decision on your investments is not a sustainable nor sound practice. This is where having a well-devised plan can help. Determining your goals, understanding how to weather obstacles during your financial journey, and having the partnership with a qualified wealth manager can help deter you from making emotionally based investment decisions.

Tax Ramifications

Understanding the tax ramifications of investment moves should be an integral and vital part of your financial plan. Taxes can significantly affect the outcome and real return of your investments. A knowledgeable professional who is apprised of ever-changing tax laws and how they can affect their clients can help navigate these ramifications.

Underestimating the Value of a Professional

In the same thread as the previous pitfall, it is important to seek the help of those who are vetted, educated, and are seasoned financial professionals. For example, we all may be able to unclog the bathroom sink, but if there is a major plumbing issue, it’s more than likely most of us will seek the help of a plumbing specialist, not just a handy person. Why wouldn’t you treat your hard-earned money in the same fashion? We may all be able to balance our checkbooks, but choosing an investment to place your hard-earn money into is more complicated with many variables that need to be considered. This is where seeking the help of a financial professional who not only understands the analytical side of investment planning, but also understands how to navigate the unexpected such as volatility in the markets, health crises, changing tax laws, and of course, let’s not forget massive emergencies that can test even the best investors, like the recent pandemic.

While we may all want to feel capable in our investing proficiency, seeking out a qualified professional can help you navigate the nuances of investing to help you pursue your financial goals with confidence.

Not Understanding that Equities Are Long-Term Investments

Placing your money into an investment and taking the chance that it will accumulate even more wealth can be intimidating, let alone scary. History has shown that those who understand investing is a long-term activity and therefore chose a plan that focuses on potential long-term returns have reaped results.

Equities are long-term investments. Even with downturns, long-term investors who have stayed with quality investments in the market for over 10, 20, 30 or 40 years have been rewarded with considerable gains.

We Are Here to Help!

We truly value our clients. We strive to understand the objective of each individual so we can create an ideal plan and help you avoid these common investing pitfalls. As a reminder, please keep us aware of any changes (such as health issues, changes in your retirement goals, or the sale of a home). The more knowledge we have about your unique situation the better equipped we will be to guide you. If you’d like to have an assessment of your investment portfolio and overall financial picture, we can discuss this at your next review meeting, or you can call us to set up an appointment.

team@stablerwm.com | (425) 646-6327

Securities and financial planning services provided through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC.

This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer, tax or financial professional. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax. Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regard to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation. The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change. IRA’s and ROTH conversions require understanding of specific rules, for complete rules on IRA’s (including who qualifies), please visit www.IRS.GOV Publication 590a or consult with a qualified professional. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.

Source: www.irs.gov. Contents Provided by The Academy of Preferred Financial Advisors, Inc.

Category

Stay Informed

Join our mailing list to receive monthly newsletters with information that impacts your financial decisions.

Certified Financial Planner

In Business 35+ Years