Politics and Investing: Equities are Non-Partisan

It would be safe to say that this election season intensified emotions and left many investors uncertain of how the results could impact equity markets and their investments.

However, savvy investors have learned that equity markets have historically cared more about an election being over than they have about who won. While you may be disappointed that the person you voted for did not win, stock prices are nonpartisan. They are more commonly tied to earnings and corporations’ health than politics. What equity markets do not like is uncertainty, and the period prior to an election is filled with just that, especially during this most recent, particularly tense election campaign.

Company earnings, valuations, and the Federal Reserve have historically affected equity markets more than election results. Strong companies find ways to survive under both Democratic and Republican Presidents. For instance, companies like Apple will continue to develop and recreate their iPhones, and Amazon will continue to deliver packages regardless of who wins the election. The best-run companies typically find ways to advance, regardless of who occupies the White House.

History has proven that a well-balanced, diversified plan that eliminates emotion is in the best interest of any investor. The election results have left many either optimistic or pessimistic about the coming years. This can test the confidence of many investors, tempting them to make emotional moves in their financial plans.

Making investment decisions solely based on the election results is not recommended. Emotional investing, or trying to time the market, is typically challenging, if not impossible. Seasoned investors adjust their holdings based on the unique circumstances they are facing and the desired result they are looking to accomplish. A sound investment strategy should focus on the long-term instead of current events or short-term fluctuations.

As your financial professional, it is our responsibility to help you invest wisely to pursue your goals. If you are nervous or concerned about your situation, please call our office and schedule some time to speak with us.

Tax Law Changes Are Coming

Regardless of whether the candidate you voted for won or not, 2025 and 2026 will bring changes to tax laws. The Tax Cuts and Jobs Act (TCJA) is scheduled to sunset on December 31, 2025. Currently, there are many different proposals for extending, expiring, or changing parts of the TCJA. Even if no tax law changes are voted in, tax law changes are scheduled to happen. Here are some items that are on the table investors should be aware of:

Income Taxes: You may find yourself with higher or lower individual tax rates.

Deductions: You could have greater or reduced itemized deductions.

Corporate Taxes: Corporate tax rates could increase or decrease.

Qualified dividends and capital gains rates: There could be higher or lower capital gains rates.

Estate Taxes: Estate tax exemptions could significantly increase or decrease.

Child Tax Credit: There could be a potential expansion for those with children.

We are keeping a close eye on upcoming tax law changes and how they may affect our clients. As your financial professional, we will guide you when appropriate so that you may plan and strategize according to your unique situation.

Diversification and Long-Term Strategies Prevail

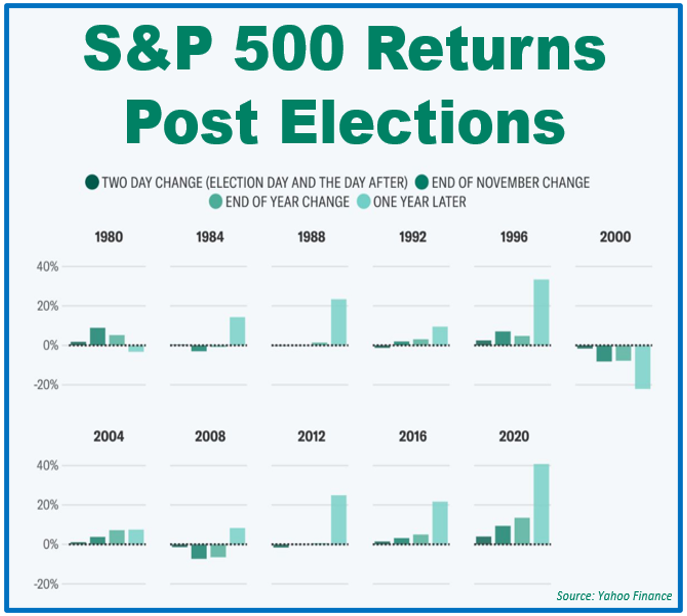

While short-term fluctuations may occur around an election, equities are more influenced by economic factors, including interest rates, corporate earnings, and inflation. As you can see from the graph, with the exception of 1981 (due to the Energy Crisis Recession) and 2021 (due to the pandemic-driven downturn), one-year post-election, the S&P 500 has had reasonable returns.

Rather than focusing on the latest headlines from media sources that thrive on the dramatic and sensational side, investors should attempt to adopt a plan that can help them navigate a variety of scenarios that may arise. Remember, a financial or tax professional could assist you by helping you build a sensible plan that can help you weather various economic situations, including election cycles. As the steward of your wealth, we trust that you feel we know your financial situation more than the talking heads on your television screen. We strive to stay current and educated and maintain an unclouded political judgment on any economic issues that could affect your plan so you can rest easily.

Having a diversified portfolio focused on long-term goals has proven to be a wise strategy for savvy investors. Helping our clients create a well-devised plan that can help them navigate volatility and uncertainty is one of our main goals. Recent history has shown us to expect the unexpected. Regardless of who is sitting in the Oval Office or in the House and Senate, we want our clients to have a plan that can weather a variety of economic scenarios that could occur in the coming years and beyond.

As a reminder, please inform us of any changes (such as health issues or adjustments to your retirement goals). The more we understand about your unique financial situation, the better equipped we will be to advise you effectively.

We take pride in providing:

- consistent and effective communication,

- a schedule of regular client meetings, and

- ongoing education for every member of our team on the issues that impact our clients.

If you would like to discuss your situation with us, please call our office.

team@stablerwm.com | (425) 646-6327

Securities and financial planning services provided through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC.

This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer, tax or financial professional. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax. Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regard to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation. The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change. IRA’s and ROTH conversions require understanding of specific rules, for complete rules on IRA’s (including who qualifies), please visit www.IRS.GOV Publication 590a or consult with a qualified professional. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.

Source: www.irs.gov. Contents Provided by The Academy of Preferred Financial Advisors, Inc.

Category

Stay Informed

Join our mailing list to receive monthly newsletters with information that impacts your financial decisions.

Certified Financial Planner

In Business 35+ Years