The Microsoft Health Savings Account (HSA): Examining a Commonly Missed Retirement Opportunity

The Health Savings Account (HSA) is one of the best kept secrets when it comes to planning for your retirement. It is often overlooked due to its lower contribution limits compared to the 401k, but don’t let that fool you – the HSA packs a serious punch. Let’s dive into what makes the Microsoft HSA an invaluable tool within your financial playbook and how you can harness its full potential.

Triple Tax Advantage: The HSA’s Superpower

The HSA offers a unique triple tax benefit. Just like a traditional 401(k), contributions to an HSA reduce your taxable income. But here’s the kicker – like a Roth IRA, the growth and withdrawals (for qualified medical expenses) are completely tax-free. This covers a wide range of expenses, from health insurance deductibles to prescription glasses to your kids’ braces. As you plan for retirement, remember, the HSA can even cover your Medicare premiums. With a recent study predicting that the average couple can expect to spend over $300,000 on health care in retirement1, the HSA is a terrific way to set aside tax advantaged funds for this future expense.

Think Long Term to Maximize Your HSA

We often see Microsoft professionals regularly contributing to their HSA, only to dip into it right away for current medical bills. Additionally, we commonly see these HSA contributions left in cash rather than invested. This is a major missed opportunity. The secret sauce for maximizing your HSA is to treat it like a growth investment. By letting it sit and grow you can enjoy the benefit of tax-free growth.

Contributing to Your Microsoft HSA Account

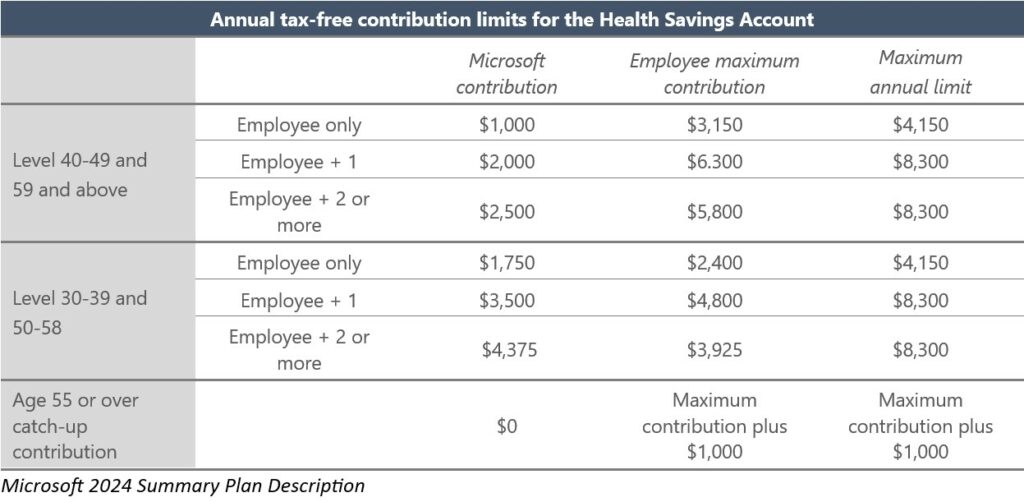

Choosing the Microsoft Health Savings Plan opens the door to HSA contributions. This is the only plan that is eligible for contributions to a Health Savings Account. For 2023, the total contribution limits are $3,850 for individual plans and $7,750 for family plans. Fast forward to 2024, and you’re looking at a limit of $4,150 for individuals and $8,300 for families. For those 55 or older you can contribute an additional $1,000. These limits include both your contributions and Microsoft’s.

If your spouse is working and has their own health insurance benefits, coordinating is key to maintaining HSA eligibility. For example, they need to be on your plan to contribute the family maximum directly. And watch out for their Flexible Spending Account – it can affect your HSA eligibility.

Microsoft chips into your HSA based on your level, depositing contributions in January and July. Fully vested, this money is yours to keep, even if you separate from Microsoft. If you’re on the Health Savings Plan but aren’t eligible to contribute to an HSA, make sure to chat with HR. You may be able to receive an alternative taxable cash contribution from Microsoft instead.

Deciding Between the HSA and the FSA

The FSA (Flexible Spending Account) is another tool to save for medical expenses in a tax advantaged way. The FSA has lower contribution limits than the HSA ($3,050 for individuals or $5,000 for families) and is a use it or lose it account where you can only roll $610 to the following year. Any amount you don’t use beyond this is forfeited. Furthermore, if you separate from Microsoft if the account isn’t used it could be lost as well – we saw this come into play with many folks that were part of the layoffs earlier this year. The HSA typically offers more bang for your buck. But if you’re not on the HSA-eligible plan, the FSA can be a decent alternative – just contrary to the HSA with the FSA make sure to use it each year.

There are some instances where after maximizing the HSA you can then contribute to an FSA as well. Be mindful of the limited purpose rules in which you can only use the FSA account after you satisfy your deductible.

An Example of the HSA in Action

Picture this, you max out your HSA family contribution for 10 years – that’s $8,300 in 2024 including what Microsoft contributes, increasing annually with inflation. Invest this in growth-oriented funds, and let’s say you average a 9% return2. In 10 years, you’re looking at around $154,000 in your HSA, ballooning to $237,000 if you let it grow another 5 years! Starting at age 50, that’s a sizeable nest egg at 65 for Medicare premiums and other retirement medical expenses.

Getting Started with Your HSA

When evaluating the different options at Microsoft it is important to prioritize wisely. Typically, you will first want to max out the 401k for Microsoft’s 50% match. From there we can look at the HSA account versus the ESPP program and other options.

With a critical topic such as health insurance, the most important thing is to first get the plan for your needs. Then we can strategize around maximizing your HSA and other tools.

Schedule Your Strategy Session

With all these important decisions, the good news is you don’t have to make them alone. Head to our website to schedule a no-cost consultation with our financial planners to chat about your HSA and retirement plan.

12022 Fidelity health care cost estimate.

2Average long-term return of the S&P 500. The example is for illustrative purposes only and not a promise of future performance.

Contact Us:

team@stablerwm.com | (425) 646-6327

No strategy assures success or protects against loss. Stabler Wealth Management and LPL Financial are not affiliated or endorsed by Microsoft.

This material was created for educational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Securities and financial planning services provided through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC.

Category

Stay Informed

Join our mailing list to receive monthly newsletters with information that impacts your financial decisions.

Certified Financial Planner

In Business 35+ Years